capital gains tax indonesia

Taking a look at the capital gains tax rates in Indonesia compared to other countries in the Asia. - are domiciled in Indonesia.

Capital Gains Tax Rate Forex Education

However the exact rate may be increased.

. In arriving at effective capital gains tax rates the. Capital gains are evaluated on the purchase price of the asset and the selling price not when you become resident. Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate.

In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows. NRI Advisory Services provides Income Tax Return in Indonesia with an excellent reputation for delivering world class services If you are searching for Capital Gains Tax Indonesia then. The treaty does not discuss capital gains.

However gains from the transfer of land and buildings are not. However sale of locally listed shares are. Generally the VAT rate is 10 percent in Indonesia.

The settlement and reporting of the tax due is. Individual resident taxpayers are individuals who. In general a corporate income tax rate of 25 percent applies in indonesia.

Residency tests are applied as follows. Tax on Capital Gains. Based on worldwide income taxation concept overseas investment income and capital gains are treated as normal income subject to income tax.

The 01 capital gains tax matches the rate Indonesian investors are charged on shares. Sellers pay capital gains tax at the rate of 5 on gains made on the disposal of assets other than land or buildings. Share deal Capital gains received by an entity in a share deal are subject.

The previous BPT rate of 15 percent has now been reduced to 10 percent. The tax is calculated on ones marginal tax bracket. Under a trade and asset sale the gain on sale proceeds including any capital gain is taxed as part of normal income at the corporate income tax rate of 22.

On the transfer of assets other than land and buildings 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. However the rate does not apply to companies or residents of Indonesia or Singapore that are. A company is regarded as Indonesian tax resident if it is established or domiciled in Indonesia or if its place of effective.

Capital gains tax rate 22 standard ratevarious Residence. Taxation on Capital Gains and Investment Income Capital gains are generally assessable at standard income tax rates together with other income of the individual. Capital gains taxes.

Capital gains on the sale of shares listed on the indonesian stock market are subject to a final tax rate. Taxation in Indonesia is determined on the basis of residency. The tax treatment on capital gains would then be subject to the domestic tax laws of each state as governed by Article 21.

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains And Why They Matter A Tax Expert Explains

Taxes In Bali Indonesia Teleport Cities

Foreign Capital Gains When Selling Us And Foreign Property

Ltcg Tax Higher Taxes Spark Panic Among Foreign Portfolio Investors Business Standard News

Ace Newsletter Capital Gains Tax In Kenya And Other Tax Updates

Income Tax Return Scrip Wise Reporting Not Needed For Short Term Capital Gains Mint

Capital Gains Tax Indonesia The Basics Of Accounting And Tax Reporting

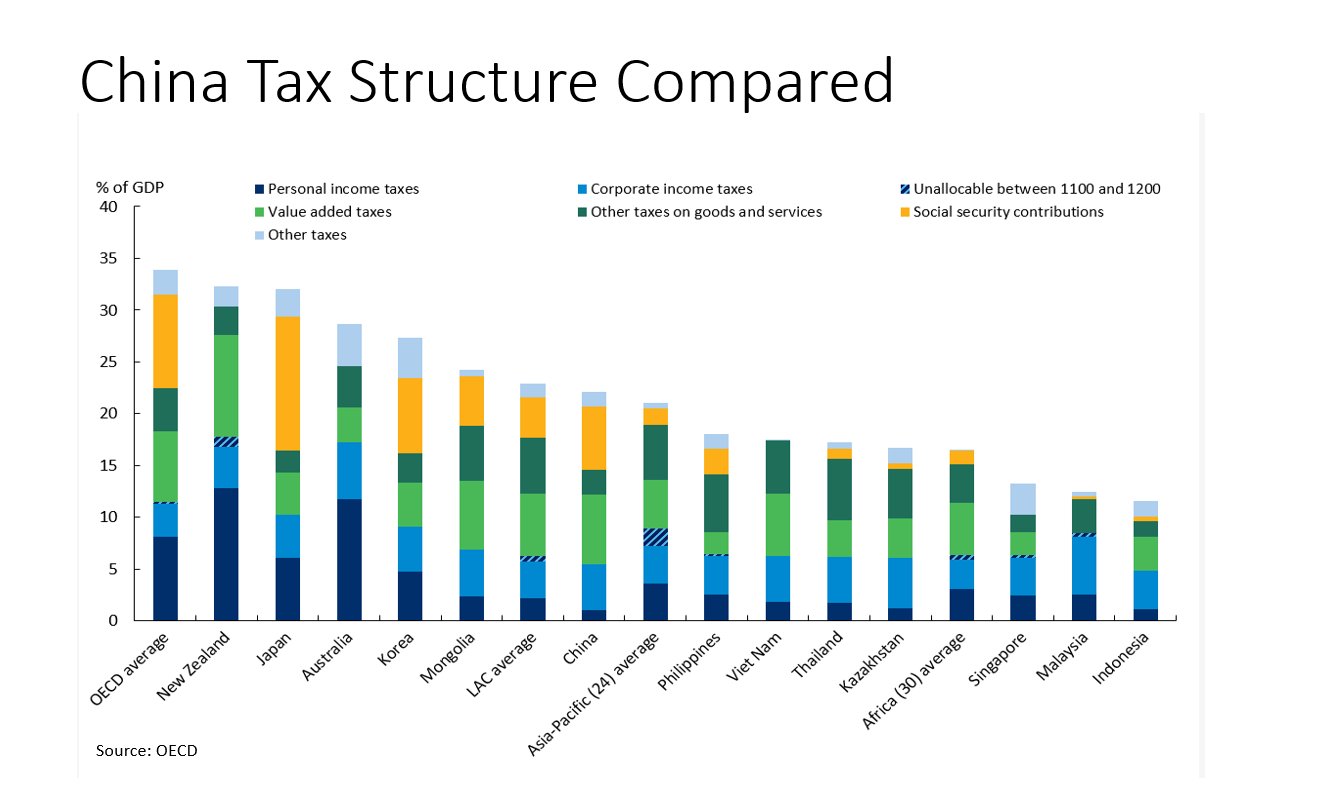

Bert Hofman 郝福满 On Twitter China S Focus On Common Prosperity Goal Is Not Yet Reflected In Its Tax Structure Personal Income Taxes Are At 1 1 Percent Of Gdp Still Low Here Is No

Pdf Do Tax Structures Affect Indonesia Economic Growth Semantic Scholar

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

How Capital Gains Affected Average Income Tax Rates From 2001 2014 Tax Policy Center

Expatriate Tax Indonesia Grant Thornton

Capital Gains Tax In Indonesia Things You Need To Know

The Indonesia Netherlands Tax Treaty Is One Of Indonesia S Biggest Tax Leaks New Research Shows Opendemocracy

Pdf The Need For Three Tier Tax Reform

Oecd Tax Al Twitter Revenues From Taxes On Goods And Services Played A Major Role In Economies In The Region Particularly In The Pacific Revenue From Other Taxes On Goods And